Learn How to Handle Crazy Times When the Market is Oversold

Bear Markets often lead to Market oversold conditions. These are typically times when fear of stocks is increasing which in turn pushes people to selling and results in dropping stock prices. This also results in rising Bond prices because the demand for non-stock investments increases. If you’re an investor, trader, or have a retirement account you might ask the following questions: When can you tell if the Market is oversold? What actions can you take on your current securities? Where and how should you allocate any cash? We will have our answer to all these questions below!

When Can You Tell if the Market is Oversold?

A Bear Market means stock prices have dropped more than 20% from recent highs. This does not necessarily mean that the market is oversold though. At YP Investors we use Point and Figure Charting Technical Analysis to determine Current Market Conditions. We use this because it has been proven and trusted throughout history for more than 100 years. As a recent example, if you were a Member of YP Investors our technical indicators showed the Market Conditions were Bad before the Market crashed from Coronavirus.

How to Determine Current Market Status Using the NYSE.

Let’s explain how we determine Current Market Conditions and specifically Oversold Market Conditions. YP Investors uses the New York Stock Exchange (NYSE) as a representation of the Market. There are over 2,000 stocks on this exchange and they have historically represented the market well.

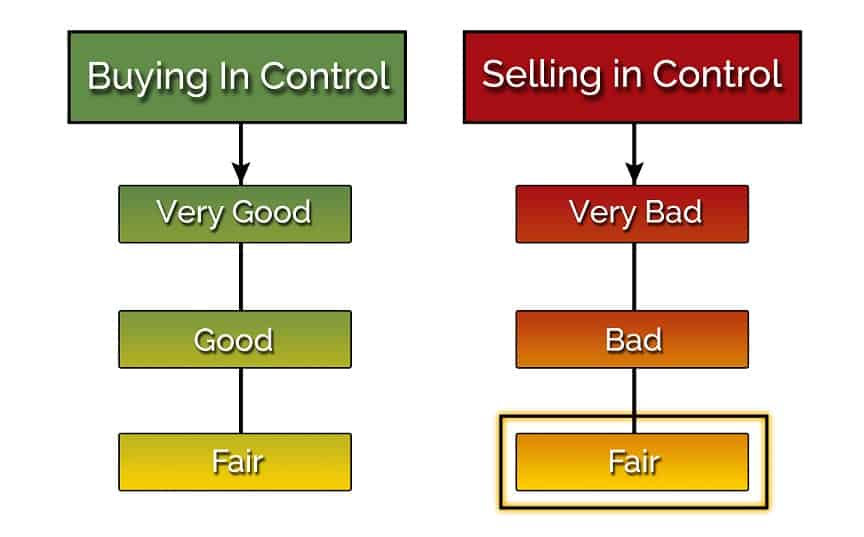

What we look at specifically is the percentage of stocks on buy signals out of the total number of stocks in the NYSE. This percentage is calculated daily after the market close. The percentage is then plotted on a Point and Figure Chart. When the chart is in X’s buying is in control and stock prices are typically rising. Alternatively, if it is in O’s selling is in control and stock prices are typically falling. If the percent of stocks on a buy signal fall below 30% this is when we classify the Market Oversold.

If the market switches to oversold it had to have dropped down meaning prices are falling. This is not an ideal time to move all our cash into stocks. Again, Market Oversold means the percentage of stocks in the NYSE on buy signals is lower than 30% and the point and figure chart is in O’s. This means more than 70% of stocks are on Sell Signals and more are trending that way.

Although it may seem like an opportune time to buy, YP Investors usually waits until the point and figure chart switches back up into X’s. Just because the NYSE is in Market Oversold territory does not mean stocks have to stop going down. It has always worked out well for us to wait for the stock price trend to switch to buying in control before moving fully into purchasing stocks. In our next sections we will explain what you can do with current investments and cash during Market Oversold conditions.

What Actions Can You Take in Market Oversold Conditions?

What can you do with Current Securities?

YP Investors has a plan in place for any Security during the Market Oversold Conditions. If we own any stocks or stock ETFs we are continuing to monitor mainly the Positive Trend Line on the point and figure chart. We like to use that as our guide and as soon as a stock violates the positive trend line and goes negative, we exchange out of that stock into cash.

A more conservative approach can be to exit out of the stock on a point and figure chart sell signal. This conservative approach can save you from selling out at a lower price if the stock continues to fall, but you can also miss out on profits if the stock bounces back.

If we are in any Cash (Money Market), Bonds, or Bond ETFs we are holding those during these Market Oversold conditions. In cash we mean securities like short term treasuries or money market funds, if you have actual cash in your portfolio lets find out how to utilize this!

Where and How Should you Allocate your Cash?

When YP Investors has cash in their portfolio we decide how aggressive/risky we want to be. The more aggressive approach is when we start the transition out of Bonds/Cash/Money Market into Stocks/Stock ETFs by at most 50% of our portfolio. We will be focusing on stocks with great fundamentals like low P/E and Price-To-Book Value. We will also check Technical Analysis to make sure it is in a Positive Trend, and hopefully beating the Market. This is where we can catch a Stocks at a very low price before Market Conditions change. It also means the Stocks can continue to drop, so this is risky.

Our conservative approach is to hold any Cash we are accumulating from Selling out of Stocks or Bonds/Money Market that hit our exit points. We will continue to hold it as cash until the Market Conditions Switch to Good or Very Good. Then we will be ready to buy into good fundamental and technical stocks once we know things are going the right direction in the market.

When the World is Fearful be Confident by Having a plan.

At YP Investors we have a great model of the market using the New York Stock Exchange. We use this to determine what the current market conditions are. Specifically, we know when the market can be in Oversold territory. When this happens, people are typically fearful of stocks and prices have fallen and can continue to fall. Although many are afraid, we are not and have a plan in place for any securities we own. We also set specific exit points. This takes the emotions out of it and allows for wise transactions.

We also have a plan for any cash we have in our portfolio. Whether it is being aggressive and buying into stocks with half our portfolio or playing it safe and holding cash until the Market changes. We know we have a plan that will work because it is proven and we don’t have to be fearful or stressed. YP Investors offers our insight as well as investing tools to help guide you in these unprecedented times. We hope to help grow your wealth and live the life you want. Become a member for free and try out our stock analysis tools!