What is Inflation in Economics?

Recently the market has been driven down by inflation fears. This brought our attention to inflation and making sure everyone is aware of how powerful and destructive it can be if left unchecked. So, what is inflation in economics? Inflation is the general rise in prices of consumer products, typically measured by an index. The most widely used index is the Consumer Price Index known as the CPI.

What is Inflation in Economics?

Inflation is the general rise in prices of consumer products, typically measured by an index. For example, comparing the current cost of a basket of goods to the cost of that same basket of goods a year ago. A rise in cost is inflation. The most widely used index is the Consumer Price Index known as the CPI.

What is Inflation in Economics: Consumer Price Index (CPI)

The Consumer Price Index (CPI) shows the average cost of goods and services as a basket of items purchased by consumers compared to that same basket of goods and services during another time period like a month or a year ago. In general it gives us a measure of retail prices. This way we can compare the cost of a basket of goods to the cost of the same basket of goods a year ago and get an indication of any changes in the cost of living.

The CPI itself is calculated from the base period of 1982-1984. It is used to measure the rate of increase or decrease in the cost of food, housing, transportation, medical care, clothing, electricity, entertainment, and services. The CPI statistics are published monthly by the Bureau of Labor Statistics (BLS).

Core CPI

There is also another important measurement of inflation well known in economics called Core CPI. The term Core CPI was not formally created by the BLS but is is a key indicator. This measures the prices for everything in CPI except for Energy and Food. Energy and Food have a tendency to fluctuate tremendously because of their high short term volatility. By excluding these categories it can help create a clearer picture of where the economy is heading.

What is Inflation in Economics: The Pros and Cons of Inflation

Inflation is not all bad. In fact it is helpful in a healthy growing economy. Small amounts of inflation can encourage economic growth because the gradual increase in prices tend to stimulate business investments. Be careful, because too much is a bad thing.

On the other hand, moderate to excessive inflation is bad for the economy. High inflation will reduce the dollar’s purchasing power. This causes less demand for goods and services because prices are so high, leading the economy on a negative path.

What is Inflation in Economics: How does it Affect Me and My Salary?

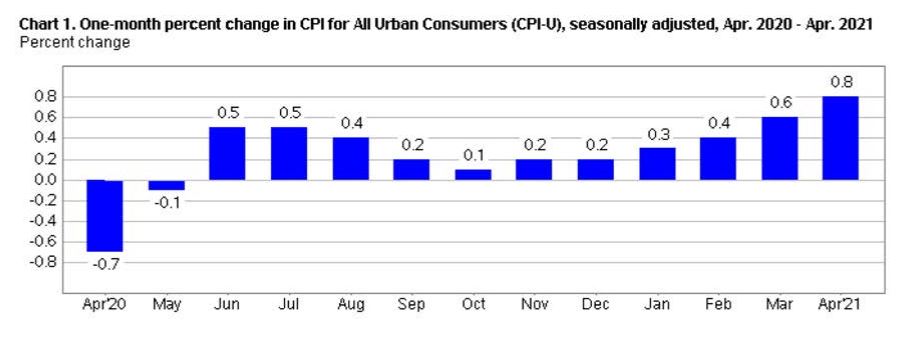

Inflation is a key economic indicator to track, and it’s something you should watch. The US just had the largest 12-month rise in inflation since 2008. From April 2020 to April 2021 the all-items index increased 4.2% (before seasonal adjustments) which is the largest 12-month increase since we saw 4.9% for the period ending September 2008.

This greatly affects everyone in the US, as it means everything is more expensive. This means the same amount of income/salary will purchase less items now than it did a year ago. This is why you need to be smart and aware about the current economic situation.

For many employees there are year end raises. Well when they give you a 2-3% raise, you are actually losing 1-2% of your salary because that increased salary will have less purchasing power with the 4% inflation rate. We’re not suggesting that you storm into your Boss’s office demanding a raise, but it can be a conversation to bring up in the year end review.

What is Inflation in Economics: What you can do to Protect Yourself from Inflation

One of the best ways to protect yourself from inflation is by investing in common stocks. Historically common stocks have greater returns than inflation. Whether you are new to investing or a seasoned veteran, we have both the general investing strategies as well as advanced stock analysis tools to help you succeed.

There are also securities that are correlated with inflation known as TIPS (Treasury Inflation-Protected Securities). TIPS, provide protection against inflation because the principal of a TIPS increases with inflation and decreases with deflation (measured by the Consumer Price Index.) TIPS are like a Bonds and pay interest twice a year. They have a fixed interest rate, but the principal is adjusted semiannually by an amount equal to the change in the CPI. They are issued with 5, 10, and 30 year maturities.

What is Inflation In Economics: Summarized

What is inflation in economics? It is a general rise in the cost of goods and services. A great way to protect yourself from inflation is to invest. We hope you were able to help you learn and grow with our information. We wish you good luck on your investments!

I admire anything that you have written on this blog. Please continue to impart wisdom to other individuals like me.