Do you have a strategy when good market conditions arise? Most will increase their wealth when market conditions are good, but they could be gaining much more with a better strategy. Whether you are investing, trading, or have a retirement account, YP Investors has strategies to significantly increase your wealth in good market conditions. (YP Pro Tip: You can see the Current Market Conditions on the YP Member Home page or in the Stock Selector tool.)

What does Good Market Conditions Mean?

When the current market condition is Good, the market is bullish which means the majority of stock prices are rising! This is the time to have an offensive strategy. You will want to convert your cash positions into Stocks/ETFs and hold good stocks/ETFs so you can grow your wealth.

How do we determine Good Market Conditions?

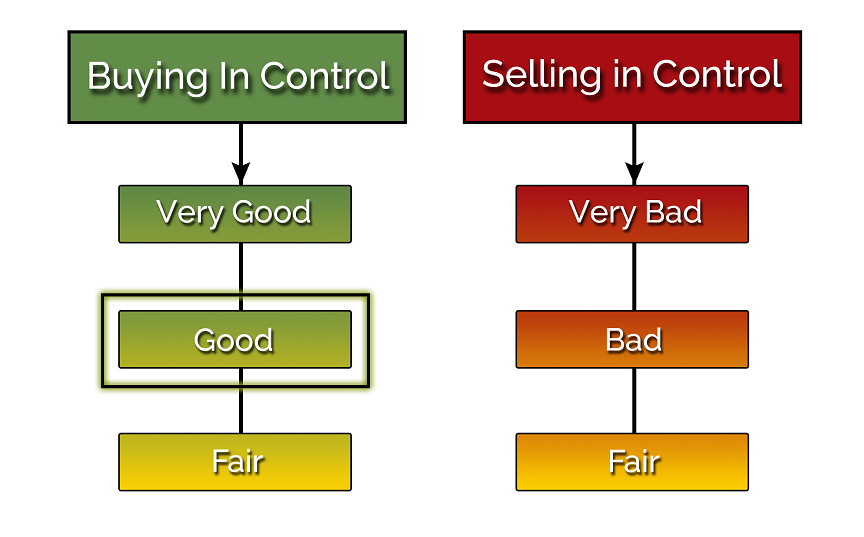

YP Investors uses Point and Figure Charting Technical Analysis to determine the Current Market Conditions. This is based on the laws of supply and demand and the actual prices of stocks. There is no room for opinions or accounting tricks to skew the chart readings. The market conditions are determined based on how many stocks are on buy signals. Good Market Conditions are when the majority of stocks in the NYSE are switching to (or already are in) buy signals. Below are YP Investors strategies for Good Market Conditions:

What is the best strategy to grow your Investing or Trading Account with Good Market Conditions?

With good market conditions YP Investors wants to be purchasing stocks and holding onto any positive trend stocks already owned. Here is YPs Strategy for finding the best stocks to invest in:

- Before purchasing any stocks, you should always make sure they have solid technical attributes using YPs Stock Selector Tool. A good technically performing stock will have at least 3 out of 5 positive technical attributes which should include a positive current trend.

- Another important step is to make sure your stock is in one of the top 3-5 Sectors. YP Investors has the Sector Rankings based on their performance on our Top Stocks and Sector ETFs page.

- To further narrow down the list of stocks to invest in, you should use fundamental analysis. Following the technical guidelines listed above in addition to your fundamental analysis should give you great success. If you do not have a fundamental analysis strategy then no worries, YP Investors has a Buffett Fundamentals Tool as well as many posts with information regarding Fundamental Analysis. YP Investors also displays a list of the top technically performing stocks each week on our Top Stocks and Sector ETFs page!

- Next determine the best price to purchase the stocks. YP Investors increases the odds of a successful investment by purchasing stocks on a Buy Signal. When you purchase stocks on a buy signal you are putting yourself at a huge advantage because the probability that the stock price rises after a buy signal is high. Check out our Point and Figure Charting Tutorial Video to learn about trend lines and buy and sell signals.

- Finally, once a stock is purchased you should monitor the current trend line as well as its positive technical attributes. If the Current Trend goes negative or the Positive Technical Attributes drop below 3 then YP Investors considers selling the stock on the next sell signal. (YP Pro Tip: The Trend is the most important Technical Attribute! Even if a stock falls to 1 Positive attribute, if it’s in a positive trend you may want to hold it. The same goes the other way. If a stock has 4 Positive Attributes but a negative trend you should probably get out of it.) As long as the Market Conditions are favorable YP Investors takes this cash and starts the process over again, purchasing more top performing stocks.

Using Stock Options Contracts to Grow your Investing Account:

- YP Investors also employs a similar strategy for stock options when the Market Conditions are Good. Learn the basics of options and check out the YP Stock Options Posts.

- Once you know the basics of options, check out this Low Risk YP Options Strategy that could get you 48% yearly returns!

If you have a 401k or Company Retirement Plan what can you do?

- Whether you have a 401k Company Plan or another type of Retirement Plan, you can and should take action when market conditions change.

- You should be able to change your investment option/strategy in any Retirement Plan that you have. During good market conditions you want the maximum growth, so you should switch to an investment option that has all stocks. Be sure they are mainly US (New York Stock Exchange) Stocks since this is what YP Investors uses as the “Market.” What you want to do is check each investment plan option and keep the options that have all Stocks. Now with just the Stock investment plans you can select a couple of them or just narrow it down to one plan that has the most US stocks. Next, don’t forget to change your current and future investments to these one or two plans that you narrowed it down to.

- Moving to an all Stocks or a Stock heavy plan should allow you to ride the wave of a Good Market and grow your retirement fund significantly.

- For complete details on how to grow your retirement account check out our article: successful strategy for your 401k and retirement account.

What if you are nearing retirement or have a significant amount in your retirement account?

- Moving to an All-Stock plan may seem risky, but remember you will be monitoring the Market Conditions through YP Investors, so you should be able to switch out of it before a big downturn.

- As always you want to be on the side of preserving your retirement money and not losing any principal. If you are planning to be travelling or may not have the access to switch your plan over if conditions change, then go with a less risky more bond heavy plan. You will only want to do this until you will be able to monitor your account fully.

- Keep in mind, going to a bond heavy plan will not grow your account much and may lose value especially after considering all of the hidden fees in most retirement plans. Make sure you are being intelligent with YP Investors and growing your wealth not just preserving it!

YP Investors hopes the strategies discussed here will help you have a plan to grow your wealth when Market Conditions are Good so you can live the life you want. We encourage you to keep yourself a step ahead of the rest by becoming a member of YP Investors. Thanks for being part of the YP Community, good luck on your investments!