Market Overbought: Fair Market Conditions

How to Know When the Market is Overbought:

Whether you are investing or trading you are bound to hear “The Market is Overbought” or similarly “The Market is Oversold.” There are news articles and blogs created each day repeating these phrases, warning to sell or encouraging to buy. Almost all of them are telling you to do something for their own benefit. For example, telling you to buy $XYZ stock only to drive up the price so they can sell it. With all the biased information out there it’s hard to trust any article. This is why it’s so important to know when the Market is overbought and oversold from a trusted source.

The only source that can be trusted is actual data. This is what YP Investors uses to determine the Market Conditions. We use all the stocks in the New York Stock Exchange (~2,000) as “The Market.” Next we check the NYSE for the number of stocks on buy signals vs the total number of stocks in the NYSE. This gives us an idea of what the Market is doing, and we call it the Current Market Conditions.

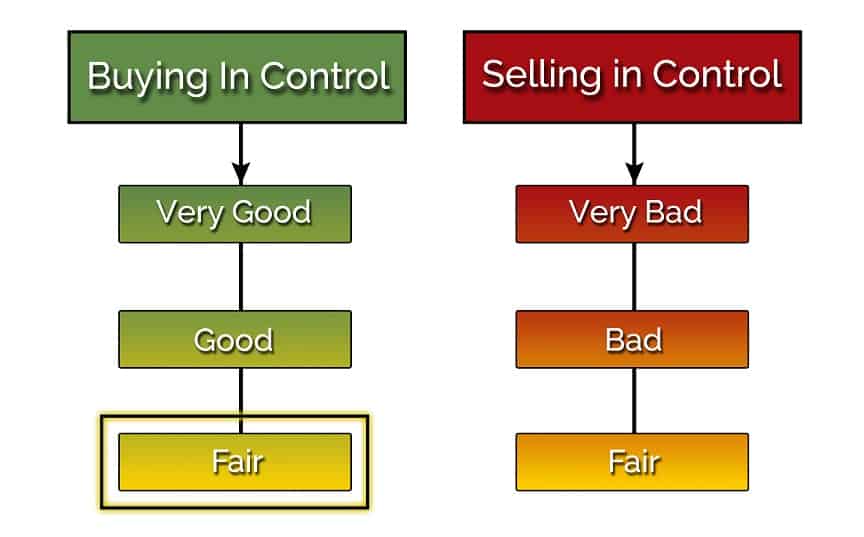

Members of YP Investors can use the Stock Selector Tool and the Member Homepage to see the Current Market Conditions anytime (Become a member for with a Free Trial Membership Here!) If more than 70% of the stocks in the NYSE are on buy signals we say the Market is overbought. When the Market is overbought this means the Market Conditions are Fair if buying is in control and Very Bad if Selling is in control.

What to Do in Fair Market Conditions

Market Overbought: What to do when using Stocks/ETFs

Whether you are an adviser or you run your own Retirement/Trading Accounts you need to know what to do in any Market Condition. When the Market Conditions are Fair and Buying is still in control this means the Market is overbought. In these Fair Market Conditions you want to Hold your Stocks/ETFs.

This is not an ideal time to buy into new stocks since the Market may not have much more room to run. Meaning the Market may not be going much higher, but it can surprise you! This is why it is very important to hold your positions. Ride the Market all the way up until the Market conditions change to Selling in control. The bottom line is to Hold your Stock/ETF positions and don’t buy into new stock positions.

What if you have a large amount of cash and want to use it? If you do not have any stocks it is okay to start some new positions. The best strategy in these overbought market conditions is to save at least 50% of your cash and then split the rest into stocks and bonds.

Note: When investing in bonds you may not have enough cash to get into a bond or properly diverse, so you can use Bond ETFs. These allow you to diversify and utilize bonds at a significantly lower price per share.

Market Overbought: What to do with a Company 401k/Retirement Plan

When using a company 401K or Retirement vehicle you should have different plan options. Some of them will contain a mixture of Stocks and Bonds and some will be all Stocks or all Bonds. If buying has been in control recently you should be in an all stocks plan. You want to keep your all stocks plan for your current and future investments in these Fair Market Conditions.

What if you don’t have an all stocks position? The best strategy at this point is to select the best performing all stocks plan and switch to that. In Fair Market Conditions like this stocks still have the potential to rise. You want to get your portfolio into stocks and ride the Market up as much as possible.

When Selecting an all stocks plan look at all of the 100% Stock plans. Next look at the underlying stocks in each of these plans. The best plan would be an equal weighted US Stock plan. If there are no equal weighted plans available then check the top 5-10 stocks in each plan. For Example one plan may have the highest percentage in Apple. Then use YP Investors Stock Selector to check if Apple is a good stock to invest in. Do this for the top 5-10 stocks from each plan and select the plan that has the most Good/Great stocks!

Have a Plan and You’ll Have Success Even in Fair-Market Overbought Conditions

The key to successful investing and trading is to have a plan. Knowing when you will enter and exit an investment or trade and why will grow your wealth. One of the keys to a good plan is knowing the Market Conditions and knowing what to do in them. Above we provide our strategy for Fair Market Conditions (Market Overbought). The main strategy in these conditions is to hold onto your investments and trades. We hope our strategies and tools help you grow your wealth so you can live the life you want! Check out all our investing posts if you haven’t already and sign up for a free trial so you can utilize our powerful tools!