We are excited to announce our newly designed newsletter. We will now have a featured Company/Stock in each release and the first is all about Meta Stock! Sign-Up Here to get our newsletters straight to your inbox!

In this newsletter we will highlight our new and exciting featured stock as well as the Current Market Updates and Conditions.

Featured Stock of this Newsletter: $META VALUE 💲🤑💲

Welcome to our brand-new featured section of our newsletter. In each newsletter we will feature a Company Stock that has been performing great, has great value, or great technicals.

Today we feature $META Stock (Meta Platforms). This company owns social media platforms including Facebook, Instagram, Reels, Threads, and WhatsApp.

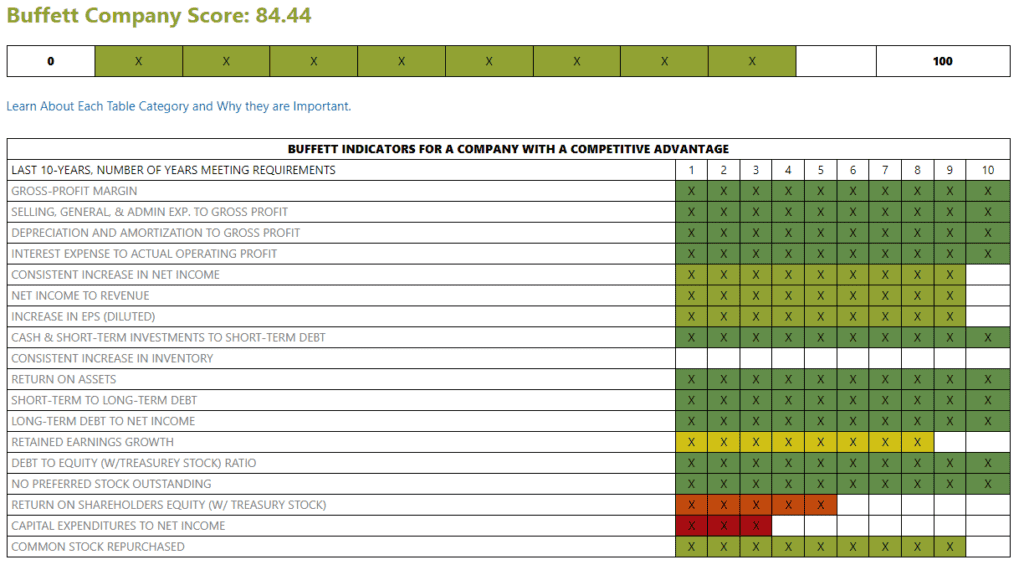

$META was selected because it looks to be a Great Value 🤑. Here are some key Buffett Fundamentals we noted:

- The current EPS of 24.5 much less than its 10-year average EPS of 164. It is also a reasonable EPS valuation for a tech stock.

- Retained Earnings growth in 8 of the last 10 years, Warren’s Favorite stat.

- Increase in EPS and Net Income in 9 of the 10 last years.

- Common Stock Repurchased in 9 of 10 last years, another one of Warren’s favorite stats.

Not only is it great Value, it is also a great performer, up over 44% this year!

Chart of the Newsletter: $META Stock Buffett Fundamentals

YP Investors Options for Income Course

Learn the Secret of the Wealthy: How to find Low Risk and Highly Profitable Investments.

The Founders of YP Investors use this exact strategy to achieve over 70% annual returns.

In our step-by-step guide, you’ll start with the basics of what a stock is and progressively build your investing knowledge, ultimately mastering the options for income strategy. As you work your way through our course each individual lesson is followed by a quiz or test to ensure you have a full understanding of the material before moving to the next lesson. This course is designed so that each lesson builds off of the previous lessons learned.

Enroll Here! Start making money work for you!

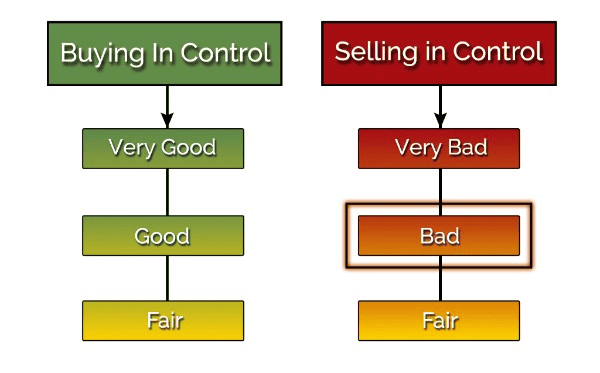

Current Market Conditions are Bad

Right now, the Market has moved down to about 47.62%on buy signals, just a few days ago it was sitting at 66% on Buy Signals. That shows the intensity of the recent sell-off. The current number of stocks is just below the midpoint so there is room for stocks to increase but your main strategy should remain defensive.

Investors are fearing a recession could be forming with the unemployment increase in just 6 months, which is the reason for the recent drop. It is always good to remember the stock market averages one correction (-10%) per year and a bear market (-20%) happens every 3-5 years.

Market Sector Updates:

Here is a glimpse into the Sector Rankings (as a YP Premium Member you can always see the Full Sector Rankings here):

RSPU (Utilities) has risen to the top 3 of the rankings after market volatility. This typically happens when markets drop because Utilities are generally less volatile than the market, so as the market drops significantly, Utilities typically drop less or even increase. RSPD (Consumer Cyclical) has dropped all the way down from 4th to last, showing the effects of inflation and the economy on consumers.

As Expected RSPT (Technology) fell from the top down to the 4th best performing sector after the recent tech heavy market sell-off.

Make sure to always keep any stock’s sector in mind. When the sector as a whole is performing well, it’s much easier for that stock to perform well. The same goes for poor performing sectors, it’s hard to swim against the current (hard to pick good stocks in a bad sector).

What does this mean?

Selling has recently taken control of stocks and we can expect stock prices to fall. You should be implementing a defensive investing/trading strategy.

Our technical indicators use the stocks in the NYSE (New York Stock Exchange) to generate the current Market conditions. This means that the majority of stocks are falling in price and will continue to fall in price until the market conditions change. It does not mean that all stocks are guaranteed to drop in price, but there is a high probability that a stock will.

Action to take on any current positions: This is a good time to take action and protect your investments or trades from losing value or dropping in price. You don’t need to sell everything immediately, but what we do at YP Investors is look for sell signals, positive trend violations, and fundamental changes. For details on the specific actions YP Investors takes when market conditions are bad check out YP Investors Strategy during Bad Market Conditions.

Action to take with any cash: Since the conditions are bad YP Investors strategy is typically to avoid purchasing any stocks at this time. As usual we will display a list of Bond ETFs that we use to preserve wealth if we have a need to invest cash.

It’s important to know: before you buy Bonds/Bond ETFs you want to hold them for more than 6 months to get at least one dividend/interest payment.

Good luck in your investments and thank you for being part of the YP Investing Community!

-YP Investors