FDA Approves GlaxoSmithKline’s RSV Vaccine

For the first time ever an RSV vaccine has been approved by the FDA. GlaxoSmithKline (GSK) is the company behind the new and approved vaccine. It has been over 60 years since RSV was discovered, and it still kills over 160,000 people a year infecting the young and elderly. The new vaccine is great news for the world and the company as it will save many lives. There are also other pharmaceutical companies on track to release an RSV vaccine as well, which helps keep the prices competitive for consumers. GSK was slow to the Covid Vaccine game which hampered its sales, but with it being first to the RSV stage it is positioning itself for huge upside.

Let’s see how GSK looks right now in our Buffett Fundamentals Tool:

GlaxoSmithKline

- $GSK

- Current Price: $36.98

- P/E: 12.84

- Buffett Bond Capitalized Price Target: $63.60

- Buffett Equity Bond Pre-Tax Yield: 8.79%

- Buffett Company Score (0-100): 66.67

Big Tech Earnings have Investors back on the Tech Train

In the latest earnings Amazon, Alphabet, Meta, and Microsoft all beat expectations. Each of the stocks were up after earnings announcements. All four together make up 15% of the S&P 500, so when they are doing well so is the Market. Each of them focused their earnings on the power of AI to improve profitability. The biggest post earnings gain came from Meta as its stock spiked 15% to a one year high after earnings despite profit falling nearly $2 Billion.

Big Tech Earnings Insight

This shows that investors expectations from Big Tech have changed. Investors are now happy with small gains today vs the double-digit earnings gains in the past. Let’s see how each of these four companies compares using our Buffett Fundamentals Tool:

Amazon

- $AMZN

- Current Price: $105.66

- P/E: 249.56

- Buffett Bond Capitalized Price Target: -$5.49

- Buffett Equity Bond Pre-Tax Yield: -0.27%

- Buffett Company Score (0-100): 49.44

Alphabet (Google)

- $GOOGL

- Current Price: $105.57

- P/E: 23.03

- Buffett Bond Capitalized Price Target: $109.76

- Buffett Equity Bond Pre-Tax Yield: 5.31%

- Buffett Company Score (0-100): 82.78

Meta

- $META

- Current Price: $232.78

- P/E: 28.08

- Buffett Bond Capitalized Price Target: $232.63

- Buffett Equity Bond Pre-Tax Yield: 5.11%

- Buffett Company Score (0-100): 80.56

Microsoft

- $MSFT

- Current Price: $310.65

- P/E: 33.49

- Buffett Bond Capitalized Price Target: $224.60

- Buffett Equity Bond Pre-Tax Yield: 3.69%

- Buffett Company Score (0-100): 84.44

Not so Techy – JNJ (Johnson and Johnson) Launches the Biggest IPO Since 2021

Johnson and Johnson just spun off it’s consumer division into Kenvue (KVUE). This includes staples like Listerine, Neutrogena, and Benadryl. It was valued at $41B and is the biggest IPO in 18 months! It’s shares spiked 20% when it started trading showing investors are more interested in profitability these days rather than growth. The new company is quite different from the IPOs in recent years where those companies promise extreme growth and have little to no profits, Kenvue has extreme profits and steady dividend payments. Johnson and Johnson will retain 90% of the company with plans to reduce its stake in the future.

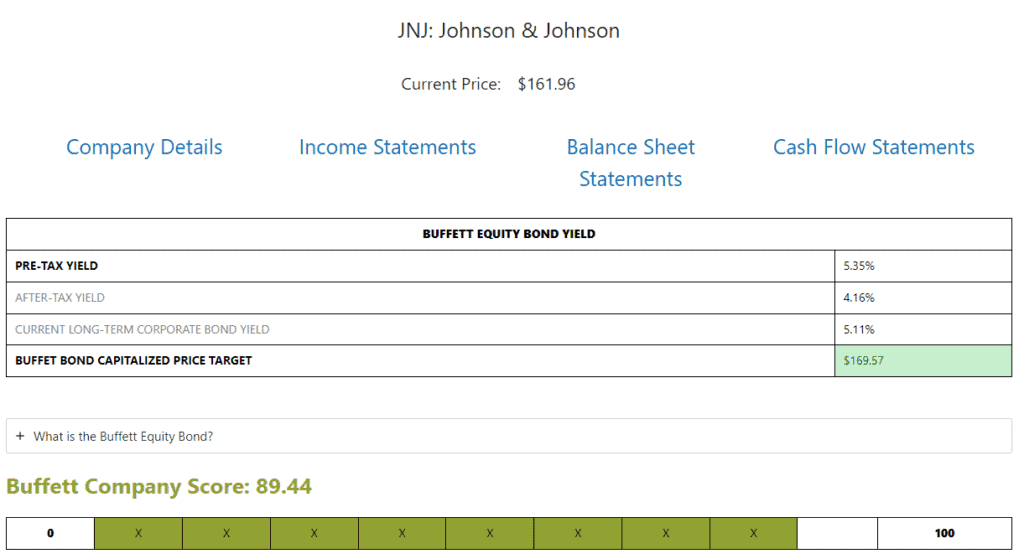

Spinning a company off can allow for smaller companies to be more focused and streamlined which can lead to bigger profits. Let’s take a look at JNJ in our Buffett Fundamentals Tool:

Johnson and Johnson

- $JNJ

- Current Price: $161.96

- P/E: 33.53

- Buffett Bond Capitalized Price Target: $169.57

- Buffett Equity Bond Pre-Tax Yield: 5.35%

- Buffett Company Score (0-100): 89.44

Buffett Fundamentals Tool Results Image: