Disney and Spectrum Square Off in the ESPN Fight

Disney and Charter just ended a heated debate that could have been the straw that broke the camel’s back for cable. Disney pulled its channels from Charter as soon as their old deal expired. In the new deal negotiations Charter wanted Disney’s streamers (Disney+, Hulu, and ESPN+) included in its deal as a bundle, since Disney has made its biggest content offerings available on those platforms. Disney said no, and it appeared they were going to part ways…until just hours before ESPN’s Monday Night Football game there was a deal made.

The news release stated the deal includes: The Disney+ basic ad-supported offering will be provided to customers who buy the Spectrum TV Select package, ESPN+ will be provided to subscribers to Spectrum TV Select Plus subscribers, and the highly anticipated ESPN streaming service will be made available to Spectrum TV Select subscribers when it launches.

What was at stake: Charter could have lost lots of viewers — ESPN alone made up over half of its top telecasts in the past year. Disney could have lost a big payout — TV viewers last year generated $28B for Disney. In the end they found a deal that made them both happy, but is this a clue for the future of cable or will streamers continue to make deals?

Let’s take a look at how Disney and Charter look using our Buffett Fundamentals Tool:

Disney

- $DIS

- Current Price: $83.68

- P/E: 65.29

- Buffett Bond Capitalized Price Target: $30.38

- Buffett Equity Bond Pre-Tax Yield: 1.85%

- Buffett Company Score (0-100): 57.22

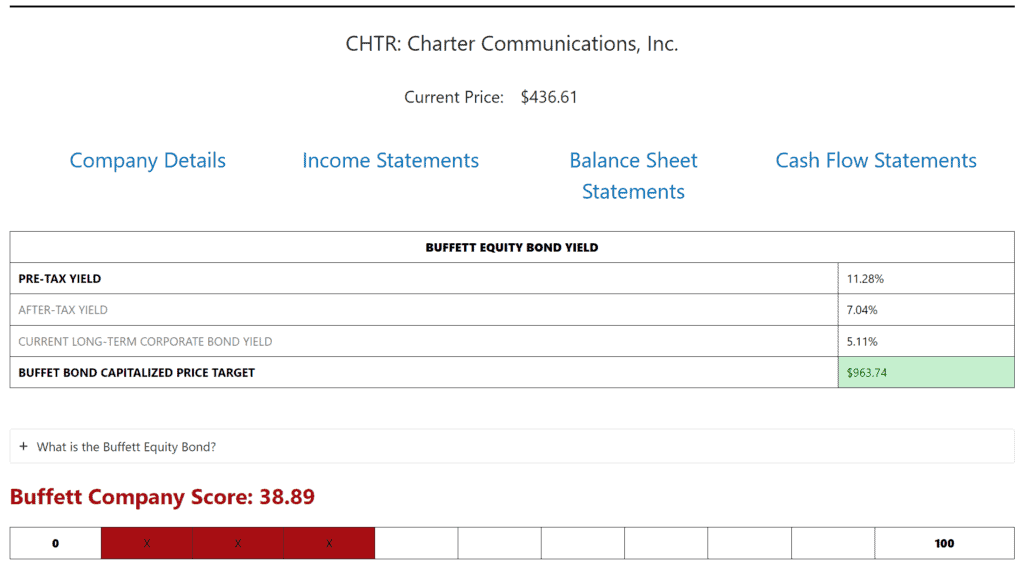

Charter

- $CHTR

- Current Price: $436.61

- P/E: 14.17

- Buffett Bond Capitalized Price Target: $963.74

- Buffett Equity Bond Pre-Tax Yield: 11.28%

- Buffett Company Score (0-100): 38.89

Gas Prices Spike as Saudi Arabia and Russia Continue to Cut Oil Production

Gas prices hit their highest seasonal record in over a decade as Saudi Arabia and Russia said they would continue to cut oil production through December. Average US gas prices rose to about $3.81/gallon, the second highest since 1994. Gas not only hurts American’s drivers, it also is a huge contributor for inflation as shipping costs go up. If inflation isn’t cooled the fed will continue to raise rates which could push the US into a Recession.

Shopify and Amazon Team Up?

Shopify announced it will let its merchants offer “Buy with Prime.” Buy with Prime allows online consumers the option to purchase their items using the payment method in their Amazon wallet when checking out through a Shopify store. This means they will also receive fast, free delivery and the option for returns through Amazon’s fulfillment network. Shopify’s stock shot up on the news. It’s a classic case of if you can’t beat em, join em! This move seems to be a win-win for both Amazon and Shopify.

Let’s take a look at how well Shopify is doing now with our Buffett Fundamentals Tool:

Shopify

- $SHOP

- Current Price: $63.75

- P/E: -40.31

- Buffett Bond Capitalized Price Target: $-69.57

- Buffett Equity Bond Pre-Tax Yield: -5.58%

- Buffett Company Score (0-100): 51.67

Buffett Fundamentals Tool Results Image: Starbucks