US Debt Ceiling Deal

The US reached a Debt Ceiling deal to raise the limit and avoid a default at the 11th hour. The good news is that the US will not default on its interest payments, the bad news is there are side effects. The biggest downside for most Americans is that student loan payments will resume in August 2023. This means up to 45 million borrowers will have to start paying their student loans at the end of August and in addition they will start to accrue interest.

The debt ceiling deal also blocks the president from pausing student loan payments without an OK from congress. Fortunately for borrowers the debt cancellation deal is not affected by the debt ceiling deal, this still remains in the hands of the supreme court. We will see how the economy holds up as borrowers are forced to continue payments this fall. The average student loan balance is $37,000 with the average monthly payment being $200-$300. That will be less money to spend in an already tight economy with inflation burning a hole in consumers’ pockets.

Apple Headset VR Move…Better Late than Never?

Apple revealed its new device this week which has been in the works for quite a while. It is an apple VR headset priced at $3,500. This is s huge outlier in the VR market considering Meta’s headset is $500, which was considered the expensive headset until now. This is the first new product since Apple launched the Apple Watch in 2014. Many are calling this CEO Tim Cook’s riskiest move especially since VR/AR device shipments fell 12% to fewer than 10M last year. Apple has a history of creating markets (e.g. iPhone and Apple Watch), but we will see if their VR goggles will create the Metaverse environment customers have been searching for.

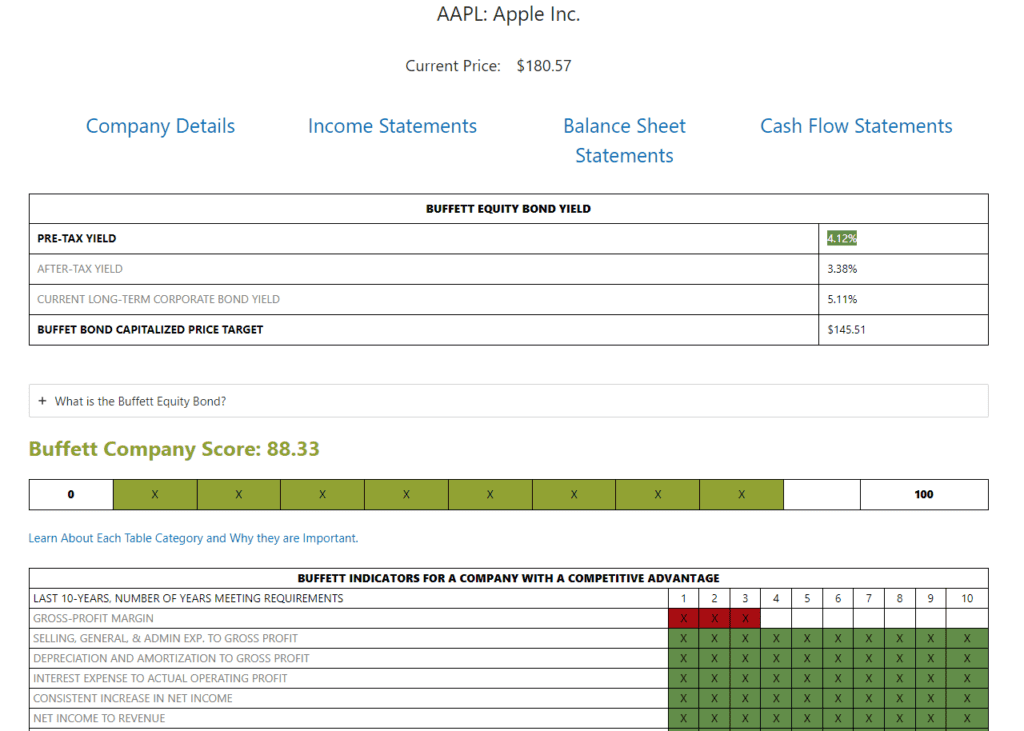

Let’s take a look at how Apple looks right now using our Buffett Fundamentals Tool:

Apple

- $AAPL

- Current Price: $180.57

- P/E: 30.22

- Buffett Bond Capitalized Price Target: $145.51

- Buffett Equity Bond Pre-Tax Yield: 4.12%

- Buffett Company Score (0-100): 88.33

Russian Knock Offs, Big Macs are not the same

It has been over a year since McDonalds and other companies have left Russia after they invaded Ukraine. McDonalds had over 850 stores in Russia and they have since been converted into Vkusno & Tochka (the Russian version of McDonalds.) The replacement seems to be faring well as there are plans to expand to over 900 stores by the end of the year. McDonalds had been in Russia for over 32 years and the Russian and Ukraine sales made up 9% of McDonalds revenue in 2021. The impact of companies pulling out of Russia seems to be hurting companies more than Russia, but that doesn’t mean Russians are happy with its knock-off economy.

Let’s take a look at how well McDonalds is doing now with our Buffett Fundamentals Tool:

McDonalds

- $MCD

- Current Price: $285.78

- P/E: 30.34

- Buffett Bond Capitalized Price Target: $201.85

- Buffett Equity Bond Pre-Tax Yield: 3.61%

- Buffett Company Score (0-100): 73.33

Buffett Fundamentals Tool Results Image: Apple