Jump to the Options Calculator Tool here.

Learn how to use our Options Calculator here.

Are you ready to make your portfolio a cash-flowing asset?

Sign-Up for our Course: How to Sell Options for Income - YP Investors Premium Investing Course

- Learn the secret to the wealthy: Finding low risk but highly profitable investments. This options strategy is exactly that and will turn your portfolio into a cash-flowing asset.

- This exact strategy is used by the YP Investors Founders to achieve over 70% annual returns.

- 13 Week Course: With our step-by-step guide learn for 20 minutes a day and by the end you'll be able to create a cash-flowing asset!

- 1-Year Premium Membership to YP Investors included ($360 Value!) with World-Class Stock Analysis Tools, Alerts, and Top Stocks Lists.

On Sale Now! Enroll and start making money work for you!

Selling Options for Income Calculations

Max Stock Price Calculator

*Total Cash ($):

*Diversification:

Option Premium ROI Calculator

*Strike Price or Stock Purchase Price ($)

*Current Option Price or Target ROI

Premium Price ($):

Stock Price Target ($):

Stock Symbol:

Strike Price ($):

Target Percent Return (%):

Number of Contracts:

Enter the Total Fees Paid ($):

Note: Required Fields are Bold.

Enter Required(*) data before using slider.

Sell Call Options

(Bearish)

| Sell Call Option (Short Call) | ||

|---|---|---|

| Premium Price Per Stock (1 Contract = 100 Shares) | ||

| Premuim Price Target | ||

| Total Fees | ||

| Total Premium Received (Max Profit) | ||

| Current Price | ||

| Strike Price | ||

| Contracts | ||

| Break Even Price | ||

| Current Profit (based on current stock price) | ||

| Target Stock Price | ||

| Projected Profit (based on target stock price) | ||

| Value of Underlying Stock at Strike Price | ||

| Value of Underlying Stock at Current Price | ||

Buy Call Options

(Bullish)

| Buy Call Option (Long Call) | ||

|---|---|---|

| Premium Price Per Stock (1 Contract = 100 Shares) | ||

| Total Fees | ||

| Total Premium Cost | ||

| Strike Price | ||

| Contracts | ||

| Break Even Price | ||

| Current Stock Price | ||

| Target Stock Price | ||

| Current ROI (Value from current stock price) | ||

| Projected ROI (based on target stock price) | ||

| Value of Underlying Stock at Strike Price | ||

| Value of Underlying Stock at Current Price | ||

Sell Put Options

(Bullish)

| Sell Put Option (Short Put) | ||

|---|---|---|

| Premium Price Per Stock (1 Contract = 100 Shares) | ||

| Premuim Price Target | ||

| Total Fees | ||

| Total Premium Received (Max Profit) | ||

| Current Price | ||

| Strike Price | ||

| Contracts | ||

| Break Even Price | ||

| Current Profit (based on current stock price) | ||

| Target Stock Price | ||

| Projected Profit (based on target stock price) | ||

| Value of Underlying Stock at Strike Price | ||

| Value of Underlying Stock at Current Price | ||

Buy Put Options

(Bearish)

| Buy Put Option (Long Put) | ||

|---|---|---|

| Premium Price Per Stock (1 Contract = 100 Shares) | ||

| Total Fees | ||

| Total Premium Cost | ||

| Strike Price | ||

| Contracts | ||

| Break Even Price | ||

| Current Stock Price | ||

| Target Stock Price | ||

| Current ROI (Value from current stock price) | ||

| Projected ROI (based on target stock price) | ||

| Value of Underlying Stock at Strike Price | ||

| Value of Underlying Stock at Current Price | ||

Sick of all the Ads? Get a Membership to YP Investors for as little as $5/month and enjoy our free tools without the hassle of popups and ads plus access to our Premium Tools.

Want Free Stocks? Get $5-$200 in Free Stocks!

YP Investors Stock Options Calculator - The Best Options Calculator

YP Investors has many stock analysis tools available strictly to our premium members, but our Stock Options Calculator is the first tool we decided to offer to everyone. This is the best stock options calculator available. Whether you have no idea what options contract you want or if you have a specific options strategy, our calculator will help guide your investments and trades.

Not familiar with stock options? No Problem, we have a great intro to options post that explains all about options including examples. Options themselves are a bit confusing at first, so be sure to also check our stock options vocabulary post. Here we go over the different names each options contract is called. This way when putting your orders in you don't get confused with your brokers options language.

How to use our Stock Options Calculator Tool:

Options Calculator: The Basics

There is a bit of information we need so we can give you some options calculations. Below are the minimum required fields you must fill out to get a calculation:

- Stock Symbol: What is the underlying stock for the option?

- Premium Price: What is the current premium price of the option?

- Strike Price: What is the strike price of the contract?

- Number of Contracts: How many of these options contracts are you buying/selling? Remember each contract controls 100 shares of the underlying stock.

With these four inputs you will be able to see some key statistics like the total premium cost/income, the break even price including the percent from the current price, and the current value of the option if it were assigned now based on the current price of the stock.

Options Calculator: Stock Price Target

The stock price target field is for you to see the potential return of all the options contracts if the underlying stock was to hit that price. It also displays the percentage increase or decrease from the current price. This allows you to figure out which options strategy you want to implement. If you think the stock will rise int he future put in a price target larger than the current price. Then let the options calculator show you which options contract will give you the best return for your prediction.

Options Calculator: Target Percent Return

The target percent return field is related to selling options contracts. It allows you to input a minimum required ROI percentage for selling an options contract. This way you are able to compare the current premium ROI vs your target premium ROI. It simplifies setting limit orders for selling options contracts so you get the returns you want.

Options Calculator: Total Fees Paid

The fees field is pretty straightforward. Simply enter any brokerage fees you will have for buying or selling options contracts. With this input the stock options calculator will be able to display your exact return, target return, and break even price. This provides clarity for each investment and trade so you know how much you will actually make from an options contract.

Stock Options Strategies

Below are a variety of different options strategies brought to you by YP Investors. The less risky strategies involve selling options contracts which will generate income from current stocks you own or plan to own. The more aggressive strategies involve buying options. Here you are at risk of loosing your full investment if the contracts expire out of the money. Alternatively you can see extraordinary profits in little time.

Options for Income

Let Money Work for You One of Robert Kiyosaki’s (author of Rich Dad Poor Dad)...

Selling Put Options for Income: How to achieve 48% ROI Annually

Selling Options for Income Selling put options for income can return 48% annually (4% per...

Shorting With Options – A Trick You Need To Know

Shorting With Options in Bad Markets is Simple and Effective When the market turns bad...

What Else YP Investors Has to Offer:

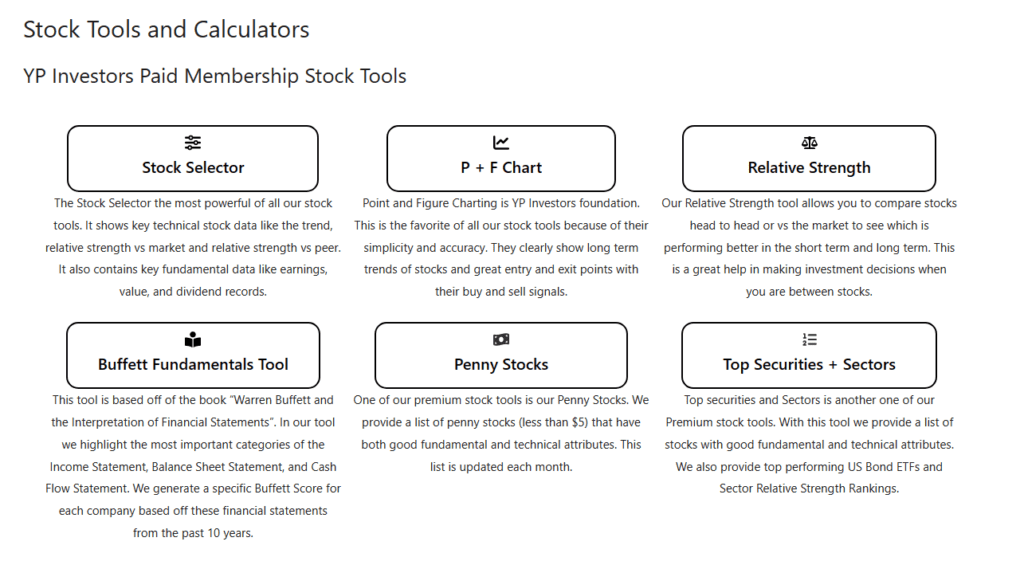

Besides our Stock Options Calculator, YP Investors has a number of premium stock analysis tools. Our core focus is Point and Figure Charting. We provide the best live Point and Figure Charts on the web along with our Relative Strength and Fundamental Analysis tools. The Stock Selector tool combines both Technical and Fundamental Analysis providing you with the health of a stock. Try all our tools out for free with our free-trial membership today.

What do you think of our Stock Options Calculator?

I like how this calculates the expected profit/return, makes my options contract selection much easier for sure.

Comment below with any improvements you would like to see on the Stock Options Calculator!

It really needs to involve date of expiration. Otherwise how does it calculate time decay?

Hey Joseph,

The current market price an option contract will have time value added. Therefore you can input this current option price into the Premium Price field of the calculator. Then this calculator will calculate the value of the option at Expiration based on your Target Stock Price. The time decay is included because by expiration the stock will either be in the money or out of the money and there will be no time money value left. Please let us know if this helps or if we are not understading your question properly. Thank you so much,

-YP Investors

Great information!