With our 6th edition of this newsletter we are going to introduce you to a stock that has NOT gone down this year and looks to be a recession powerhouse!

We will also go over Trump’s Tariff Policy and what happened the last time a President enforced a similar policy…it’s not looking good 😬

Are you a subscriber? Be sure to subscribe to our newsletter to instantly receive our newsletters and important stock market insights!

That one stock Unbothered by Tariffs…T.J. Maxx!🙃

TJ Maxx Stock is this Newsletter Feature: $TJX

$TJX (The TJX Companies, Inc.) is the featured stock in this Newsletter and we will get into why next, but first some details about the company: TJX Companies, Inc. operates as an off-price apparel and home fashions retailer. As of February 23, 2022, it operated 1,284 T.J. Maxx, 1,148 Marshalls, 850 HomeGoods, and tons of others including online sales.

With the Stock Market tanking since Trump has implemented a Tariff policy almost every stock is in the red YTD (year-to-date), however $TJX actually hasn’t gone down this year! The YTD return is about even (up 0.37% as of 4/4/2025.)

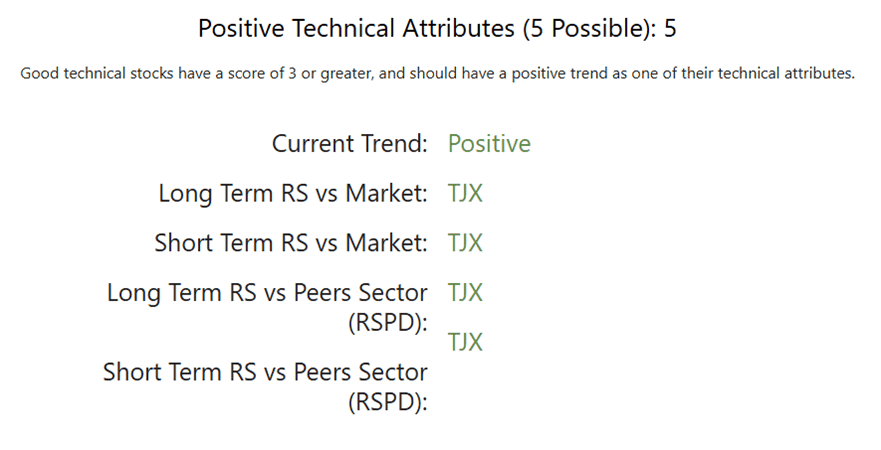

That’s not the only impressive stat for $TJX, it also has a Perfect 5/5 Technical Score on the Stock Selector and a pretty solid Buffett Fundamental Score! The other main reason we featured this stock is because it seems to be recession proof.

As prices rise from the Tariff policy consumers will look to save money. $TJX is able to offer brand names at discount prices. They can offer low prices because they purchase leftover inventory from brands and department stores.

Those brands and stores need to make room for new items so rather than tossing the old, they get some money back selling the leftovers to $TJX. A low cost to $TJX allows for low prices, which consumers love in a recession.

Here are the impressive Technicals and Fundamentals of $TJX:

Technical Analysis Notes from the Stock Selector Tool:

- $TJX has increased 24% from 1 year ago, and YTD about even.

- Positive Long-Term Trend: Stock prices should increase in the long term

- 5/5 Positive Technical Attributes: Great indicator of a strong technically performing stock

- $TGX is acing all 5 technical attributes showing that it is outperforming the Market and its Peers.

Here are some key Buffett Fundamentals we noted:

- Retained Earnings growth in 8 of the last 10 years. One of Warren’s Favorite indicators of a strong company with a competitive advantage.

- Consistent Increase in Inventory in 10 of the 10 last years. Warren Buffett has found that consistent rising in inventory (along with rising net earnings) show a company has a durable competitive advantage.

- Perfect Return on Assets in 10 of the 10 last years.

Table of the Newsletter: $TJX Technical Performance

Why Trump’s Tariff Policy is Very Concerning ☠

Almost everything that is happening now has happened before in history to a similar degree. Today’s Tariff Policies are eerily similar to the policies put in place by President Hoover in the 1930s, and the results were disastrous! Here are the details and what the future of the US may be looking like:

📜 What happened:

In 1930, President Herbert Hoover signed the Smoot-Hawley Tariff Act into law. This policy raised U.S. tariffs on over 20,000 imported goods to protect American farmers and businesses during the economic downturn.

💥 What it caused:

- Other countries retaliated by also raising tariffs on U.S. goods.

- This led to a massive decline in global trade—worldwide exports and imports fell.

- It hurt American exporters, especially farmers, who lost access to key foreign markets.

- Most economists agree it worsened and prolonged the Great Depression.

📉 The big takeaway:

The Smoot-Hawley Tariff is often cited as a lesson in how protectionist trade policies can backfire, especially during times of global economic instability.

We can only hope the current tariff policies don’t end up being as severe as they have come out to be. With the temporary relief of some tariffs announced on 4/9/25, it may give policy makers time to strategize a better plan that won’t propel the economy into a depression.

YP Freebies:

- Finance: Get a FREE Stock from Robinhood

- Retirement Calculator: Calculate how long and how much it will take to reach your retirement goals

- Stock Options Calculator: Calculate which Options Contract is best for you

- Buffett Fundamentals Tool: A Free Version of our most powerful investing tool

- Point and Figure Charts: Invest and trade with confidence using the Free Version of our advanced Point and Figure Charts

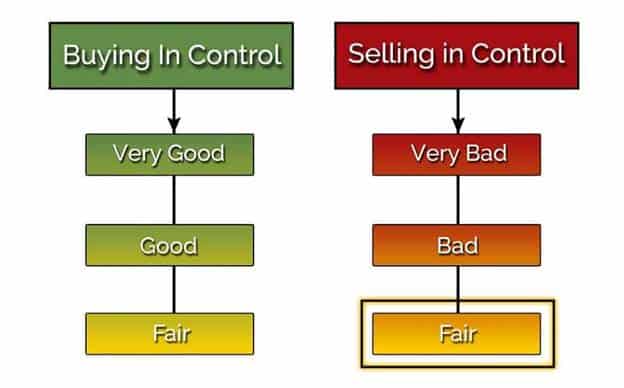

Current Market Conditions are Fair-Oversold!

The last time the Market Conditions were Oversold was back in September 2022 when both Europe and the US Central banks had to raise rates to fight inflation.

We use the New York Stock Exchange as a market reference and look at the Point and Figure Chart Buy and Sell Signals. Just 9 days ago the NYSE was at about 39.96% of stocks on Buy signals, and now that percentage has dropped all the way down to 19.79% even after yesterday’s rally.

When we see stocks on buy signals dip below 30% we can start thinking about getting back on the offense.

If you are a member of YP Investors we will automatically notify you instantly anytime the Market Conditions change (Become a Member here).

What does this mean?

NOTE: This is Not Investment Advice.

Selling is still in control for the majority of stocks so stock prices can still drop, but the Market has entered into Oversold territory.

Our technical indicators use the stocks in the NYSE (New York Stock Exchange) to generate the current Market conditions. This means that the majority of stocks are still on sell signals, but are in now in Oversold territory. This may be a time to start acquiring securities, but prices can still drop so be cautious.

Action to take on any current positions: YP Investors is holding their positions in Stock/ETF Securities at this time as long as they are within our technical and fundamental requirements. We are also starting to transition out of Bonds/Bond ETFs up to 50%.

Note: Be aware of any upcoming Bond Dividend/Interest Payments before exiting.

Action to take with any cash: YP Investors is planning to start the transition out of Bonds/cash into Stocks/ETFs by at most 50% of our portfolio. We will be focusing on stocks with great fundamentals meaning a high Buffett Fundamentals Score. We will also check Technical Analysis to make sure it is in a Positive Trend, and hopefully beating the Market.

Tutorials!

Don’t forget, we have a number of tutorial videos which can help in understanding our Tools and Charts! Click here to go to our Video Tutorials page.

Not a member of YP Investors yet?

No problem! Sign up for a Free Trial and gain full access to YP Investors including our exclusive Stock Analysis tools, top securities picks, Member Alerts, and more!

Good luck in your investments and thank you for being part of the YP Investing Community!

-YP Investors