Happy New Year from YP Investors! We have our 2024 Stock Market Review in Today’s special New Year Newsletter edition.

2024 was another great year for US Stocks as the S&P 500 had over a 23% return! Last year’s return was over 26%. This is only the 4th time in the last 100 years that the market has had back-to-back 20%+ returns.

Today we will look back at the Best and Worst Performing Stocks of 2024. We also look at how the Top Performers od 2023 faired last year.

Below are lists of the top and bottom performing stocks, a new and exciting announcement for YP Investors, Current Market Conditions, and Updated Securities lists.

Top 2024 Stock Market Performers:

The Top Performers of the 2024 stock market were Tech and Healthcare companies.

- TSSI +4,292.59%

TSS, Inc.

Sector: Technology

- SNYR +3,597.48%

Synergy CHC Corp.

Sector: Healthcare

- WGS +2,694.91%

GeneDx Holdings Corp.

Sector: Healthcare

- DRUG +2,418.88%

Bright Minds Biosciences Inc.

Sector: Healthcare

- KULR +1,818.92%

KULR Technology Group, Inc.

Sector: Technology

Worst Performers of 2024:

The worst performers of the 2024 stock market were a mix of sectors but the most from Technology.

- CETX -99.97%

Cemtrex, Inc.

Sector: Technology

- EFSH -99.93%

1847 Holdings LLC

Sector: Industrials

- ADTX -99.93%

Aditxt, Inc.

Sector: Healthcare

- TRNR -99.92%

Interactive Strength Inc.

Sector: Consumer Cyclical

- MULN -99.92%

Mullen Automotive, Inc.

Sector: Technology

How did the Top Performers of 2023 do in 2024?:

All 5 top performers of 2023 had positive returns in 2024 and 4/5 beat the market return! This small sample provides good evidence of Warren Buffett’s philosophy that you hold onto your winning stocks.

- SLNO +1,932.83% (2023)

2024: +11.68%

Soleno Theraputics Inc

Sector: Healthcare

- CVNA +1,016.88% (2023)

2024: +284.13%

Carvana Co.

Sector: Consumer Discretionary

- AAOI +922.22% (2023)

2024: +90.79%

Applied Optoelectronics Inc

Sector: Technology

- MYO +879.66% (2023)

2024: +28.54%

Myomo Inc

Sector: Healthcare

- ACIC +792.45% (2023)

2024: +47.85%

American Coastal Insurance Corp

Sector: Financial

YP Freebies:

- Finance: Get a FREE Stock from Robinhood

- Retirement Calculator: Calculate how long and how much it will take to reach your retirement goals

- Stock Options Calculator: Calculate which Options Contract is best for you

- Buffett Fundamentals Tool: A Free Version of our most powerful investing tool

- Point and Figure Charts: Invest and trade with confidence using the Free Version of our advanced Point and Figure Charts

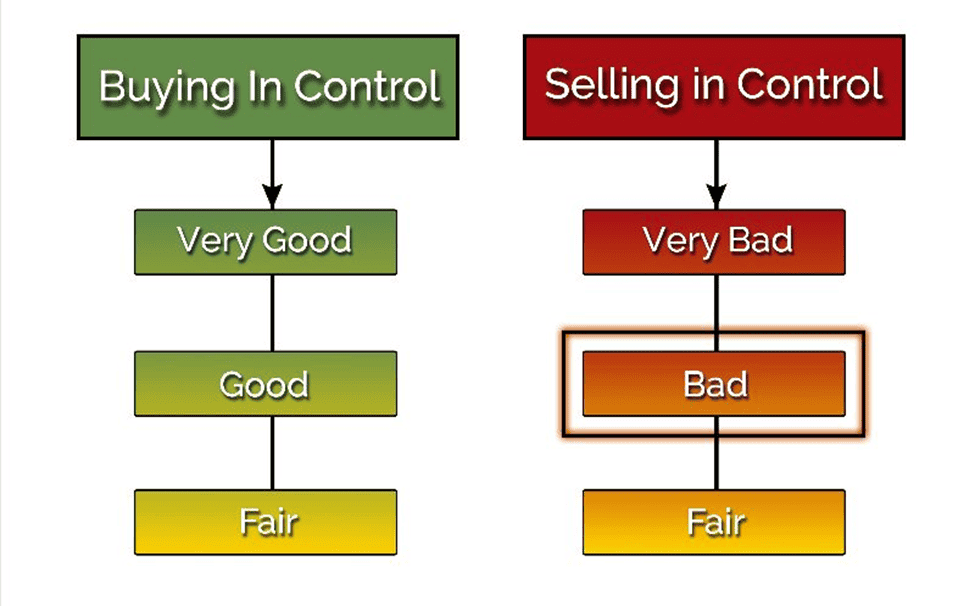

2024 Stock Market Conditions were mainly Good.

Current 2025 Market Conditions:

Right now, the Market has moved down to about 45.18% on buy signals. The current number of stocks is just below the midpoint so there is room for stocks to increase but your main strategy should remain defensive.

Investors are fearing a recession could be forming with interest rates to remain high and Tariff concerns ahead. It is always good to remember the stock market averages one correction (-10%) per year and one bear market (-20%) every 3-5 years.

If you are a member of YP Investors we will automatically notify you instantly anytime the Market Conditions change (Become a Member here).

What does this mean?

NOTE: This is Not Investment Advice.

Selling has recently taken control of stocks and we can expect stock prices to fall. You should switch to a defensive investing/trading strategy.

Our technical indicators use the stocks in the NYSE (New York Stock Exchange) to generate the current Market conditions. This means that the majority of stocks are falling in price and should continue to fall in price until the market conditions change. It does not mean that all stocks are guaranteed to drop in price, but there is a high probability that a stock will.

Action to take on any current positions: This is a good time to take action and protect your investments or trades from losing value or dropping in price. You don’t need to sell everything immediately, but what we do at YP Investors is look for sell signals, positive trend violations, and fundamental changes. For details on the specific actions YP Investors takes when market conditions are bad check out YP Investors Strategy during Bad Market Conditions.

Action to take with any cash: Since the conditions are bad YP Investors strategy is typically to avoid purchasing any stocks at this time. As usual we will display a list of Bond ETFs that we use to preserve wealth if we have a need to invest cash.

It’s important to know: before you buy Bonds/Bond ETFs you want to hold them for more than 6 months to get at least one dividend/interest payment.

Tutorials!

Don’t forget, we have a number of tutorial videos which can help in understanding our Tools and Charts! Click here to go to our Video Tutorials page.

Not a member of YP Investors yet?

No problem! Sign up for a Free Trial and gain full access to YP Investors including our exclusive Stock Analysis tools, top securities picks, Member Alerts, and more!

Good luck in your investments and thank you for being part of the YP Investing Community!

-YP Investors