Hello from YP Investors. In our 4th edition of the revamped newsletter we are featuring the Garmin stock, it’s more than just a GPS company.

We also have the Current Market Updates and Conditions.

Are you a subscriber? Be sure to subscribe to our newsletter to instantly receive our newsletters and important stock market insights!

Garmin Stock Earning and Performance Perfection 👌

Featured Stock of the Newsletter: $GRMN

Garmin is the featured company in this Newsletter $GRMN (Garmin Ltd.). Garmin is a leader in GPS technology, providing innovative devices for various activities and professions including: Fitness, Outdoors, Aviation, Marine, and Auto.

$GRMN was selected because it has a Perfect 5/5 Technical Score on the Stock Selector and an excellent Buffett Fundamental Score! It is up 75% in the past year! Here are the impressive Technicals and Fundamentals of Garmin:

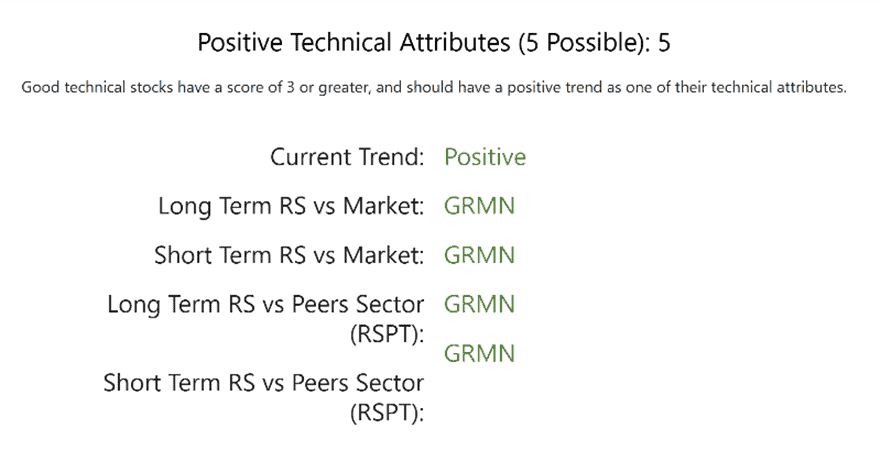

Technical Analysis Notes from the Stock Selector Tool:

- $GRMN has increased 75% from 1 year ago.

- Positive Long-Term Trend: Stock prices should increase in the long term

- 5/5 Positive Technical Attributes: Great indicator of a strong technically performing stock

- Garmin is acing all 5 technical attributes showing that it is outperforming the Market and its Peers.

Here are some key Buffett Fundamentals we noted:

- Retained Earnings growth in 9 of the last 10 years. One of Warren’s Favorite indicators of a strong company with a competitive advantage.

- Consistent Increase in Inventory in 10 of the 10 last years. Warren Buffett has found that consistent rising in inventory (along with rising net earnings) show a company has a durable competitive advantage.

Perfect Return on Assets and Gross Profit Margin in 10 of the 10 last years.

Table of the Newsletter: $GRMN Technical Perfection

Stock Selector Tool

Options for Income Course

Black Friday Sale Starts Now!

Limited Time Sale: $297

Less than the Cost of a Premium Membership!

Includes a Premium Membership 🤩 $360 Value + $535 Course Value

$598 in Savings!

Learn the how to make money work for you: The Secret of the Wealthy.

Get actual results that can achieve over 70% annual returns.

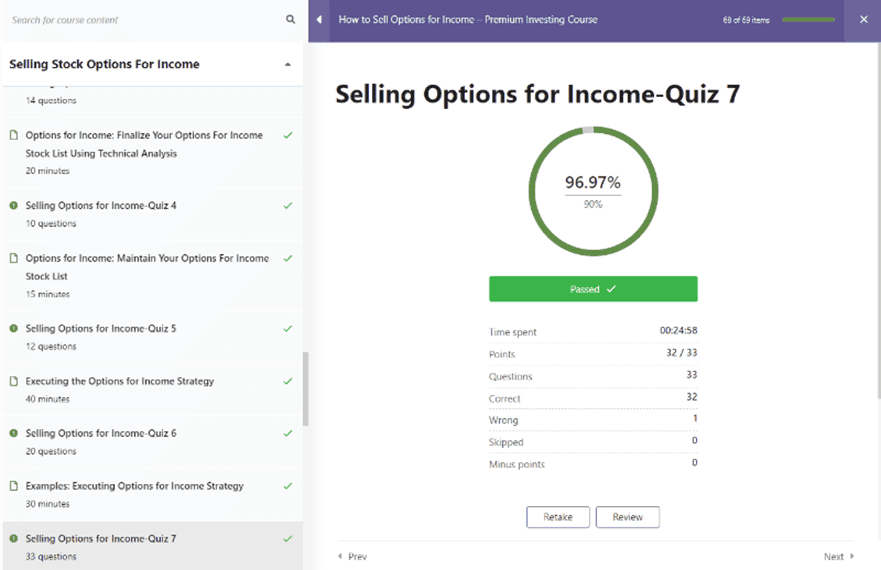

In our step-by-step guide, you’ll start with the basics of what a stock is and progressively build your investing knowledge, ultimately mastering the options for income strategy.

As you work your way through our course each individual lesson is followed by a quiz or test to ensure you have a full understanding of the material before moving to the next lesson. This course is designed so that each lesson builds off of the previous lessons learned.

Enroll Now! Start making money work for you!

YP Freebies:

- Finance: Get a FREE Stock from Robinhood

- Retirement Calculator: Calculate how long and how much it will take to reach your retirement goals

- Stock Options Calculator: Calculate which Options Contract is best for you

- Buffett Fundamentals Tool: A Free Version of our most powerful investing tool

- Point and Figure Charts: Invest and trade with confidence using the Free Version of our advanced Point and Figure Charts

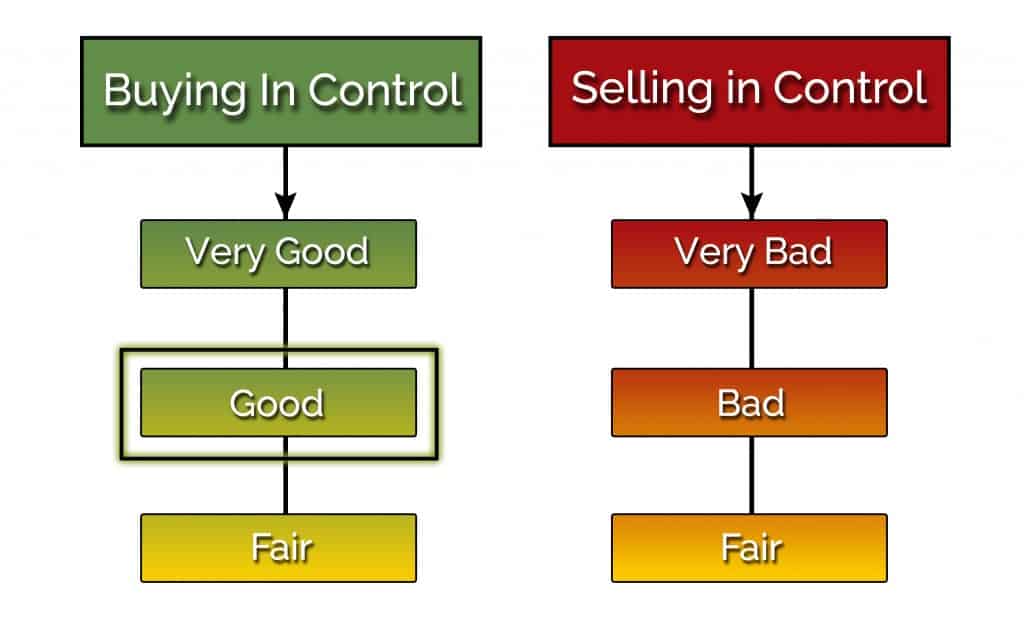

Current Market Conditions are Good!

YP’s technical indicators suggested the Market (NYSE) Conditions are Good, but they are hanging on by a thread at the moment.

Right now, the Market has about 61.39% of Stocks on buy signals. The amount of stocks on Buy Signals is getting close to overbought territory so be somewhat aware, but now worries if you are a member. We will update you as soon as the Market changes to these conditions.

If you are a member of YP Investors we will automatically notify you instantly anytime the Market Conditions change (Become a Member here).

What does this mean?

NOTE: This is Not Investment Advice.

Buying has taken control in Stocks. The market is bullish and stock prices should continue to rise. The Market Conditions are Good!

Our technical indicators use the stocks in the NYSE (New York Stock Exchange) to generate the current Market conditions. Good Market Conditions means that Stocks are already in or transitioning to buy signals. For YP Investors this is a good time to invest into sound Fundamental and Technical Stocks. (Check out our updated Top Stocks and Penny Stocks Pages)

Below is a summary of what actions YP Investors Takes. Read the list of the all the scenarios and actions we take during Good Market Conditions.

Action to take on any current positions: YP Investors is holding their positions in Stock/Stock ETF Securities at this time if they are still in Positive Trends and solid Fundamentally. We are also starting to transition out of Bonds/Bond ETFs an into Stocks/Stock ETFs.

Action to take with any cash: YP Investors is planning to start the transition out of Bonds/cash into Stocks/Stock ETFs. We will be focusing on stocks with great fundamentals like our Buffett Fundamentals Tool suggests. We will also check Technical Analysis to make sure it is in a Positive Trend, and hopefully beating the Market. Remember to look for Buy Signals as a good entry point for a Stock.

Tutorials!

Don’t forget, we have a number of tutorial videos which can help in understanding our Tools and Charts! Click here to go to our Video Tutorials page.

Not a member of YP Investors yet?

No problem! Sign up for a Free Trial and gain full access to YP Investors including our exclusive Stock Analysis tools, top securities picks, Member Alerts, and more!

Good luck in your investments and thank you for being part of the YP Investing Community!

-YP Investors