Chipotle Earnings Power: Our Featured Story

Welcome back to our new and improved Newsletter from YP Investors.

In our second edition of this newsletter we will highlight the burrito slinging company, Chipotle, as well as the Current Market Updates and Conditions.

Sign-Up Here to get our newsletters straight to your inbox!

Chipotle’s Retained Earnings Power 💪

Featured Stock of the Newsletter: $CMG

Chipotle is the featured company in this Newsletter $CMG (Chipotle Mexican Grill, Inc.). This company owns and operates Chipotle Mexican Grill restaurants in the US, Canada, and Europe.

$CMG was selected because it has had Retained Earnings Growth for the last consecutive 19 Years! Since 2005 Chipotle has been growing its retained earnings every single year. Warren Buffett loves a company that both has and grows retained earnings consistently because this shows they have a strong earning power. The strong earning power indicates a company with a durable competitive advantage aka Warren Buffett’s profit puppies 🐶

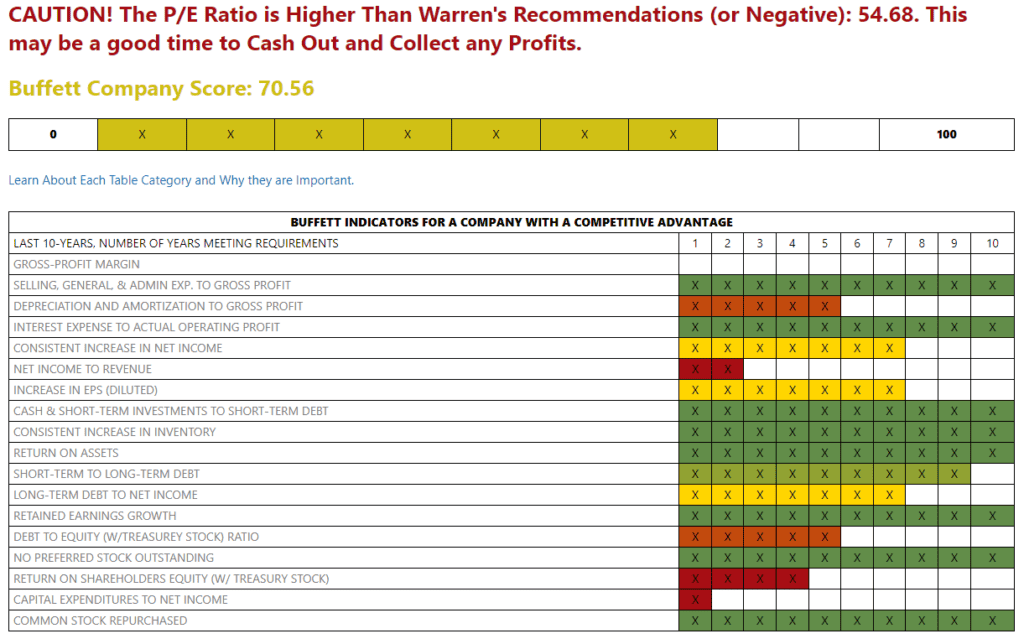

Here are some key Buffett Fundamentals we noted:

- The current EPS of 54.68 much less than its 10-year average EPS of 78.21, but this is still an expensive stock in terms of value investing (Warren Buffett). This means the current earnings of Chipotle would take 54 years to pay off all the stock at its current price.

- Retained Earnings growth in 10 of the last 10 years, and 19 years in a row as we mentioned previously!

- Perfect Return on Assets in 10 of the 10 last years.

- Common Stock Repurchased in 10 of 10 last years, another one of Warren’s favorite stats.

Technical Analysis Notes from the Stock Selector Tool:

- $CMG has increased over 45% from 1 year ago and over 25% this year alone!

- Positive Long-Term Trend: Stock prices should increase in the long term

- 4/5 Positive Technical Attributes: Great indicator of a strong technically performing stock

Chart of the Newsletter: $CMG Retained Earnings Growth

YP Investors Options for Income Course

Learn the how to make money work for you: The Secret of the Wealthy.

Get actual results that can achieve over 70% annual returns.

In our step-by-step guide, you’ll start with the basics of what a stock is and progressively build your investing knowledge, ultimately mastering the options for income strategy. As you work your way through our course each individual lesson is followed by a quiz or test to ensure you have a full understanding of the material before moving to the next lesson. This course is designed so that each lesson builds off of the previous lessons learned.

Enroll Here! Start making money work for you!

YP Freebies:

- Finance: Get a FREE Stock from Robinhood

- Retirement Calculator: Calculate how long and how much it will take to reach your retirement goals

- Stock Options Calculator: Calculate which Options Contract is best for you

- Buffett Fundamentals Tool: A Free Version of our most powerful investing tool

- Point and Figure Charts: Invest and trade with confidence using the Free Version of our advanced Point and Figure Charts

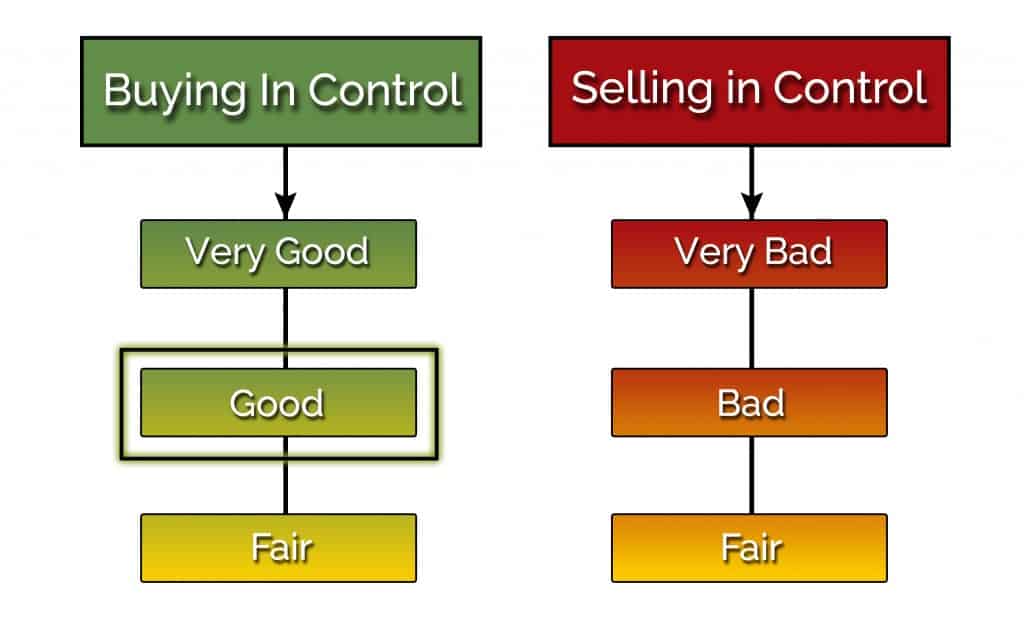

Current Market Conditions are Good!

YP’s technical indicators suggested the Market (NYSE) Conditions are Good. This has been a great week for the Market, with constant gains each day.

Right now, the Market has about 57.71% of Stocks on buy signals. This is just above the midpoint so there is room for stocks to continue to increase in price.

If you are a member of YP Investors we will automatically notify you instantly anytime the Market Conditions change (Become a Member here).

What does this mean?

NOTE: This is Not Investment Advice.

Buying has taken control in Stocks. The market is bullish and stock prices should continue to rise. The Market Conditions are Good!

Our technical indicators use the stocks in the NYSE (New York Stock Exchange) to generate the current Market conditions. Good Market Conditions means that Stocks are already in or transitioning to buy signals. For YP Investors this is a good time to invest into sound Fundamental and Technical Stocks. (Check out our updated Top Stocks and Penny Stocks Pages)

Below is a summary of what actions YP Investors Takes. Read the list of the all the scenarios and actions we take during Good Market Conditions.

Action to take on any current positions: YP Investors is holding their positions in Stock/Stock ETF Securities at this time if they are still in Positive Trends and solid Fundamentally. We are also starting to transition out of Bonds/Bond ETFs an into Stocks/Stock ETFs.

Action to take with any cash: YP Investors is planning to start the transition out of Bonds/cash into Stocks/Stock ETFs. We will be focusing on stocks with great fundamentals like our Buffett Fundamentals Tool suggests. We will also check Technical Analysis to make sure it is in a Positive Trend, and hopefully beating the Market. Remember to look for Buy Signals as a good entry point for a Stock.

Tutorials!

Don’t forget, we have a number of tutorial videos which can help in understanding our Tools and Charts! Click here to go to our Video Tutorials page.

Not a member of YP Investors yet?

No problem! Sign up for a Free Trial and gain full access to YP Investors including our exclusive Stock Analysis tools, top securities picks, Member Alerts, and more!

Good luck in your investments and thank you for being part of the YP Investing Community!

-YP Investors