Amazon Earnings Grow

Amazon just released a fantastic earnings report. The stock is up over 60% this year as Amazon earnings grow, and in the earnings report revenue was up 11% and profits doubled.

What’s not fantastic is Amazon’s grocery business. It owns only 4% of the US grocery market and the business lost over $700 million last year. It is one of the businesses Amazon is in that is still not profitable, maybe because groceries are just too hard to ship? Part of the problem also may be that Amazon owns 3 different grocery options Amazon.com, Amazon Fresh, and Whole Foods. Consolidating might make it profitable, but we will have to see which path they choose if they choose to continue with groceries.

Let’s take a look at how Amazon looks right now using our Buffett Fundamentals Tool:

Amazon

- $AMZN

- Current Price: $139.57

- P/E: 110.88

- Buffett Bond Capitalized Price Target: $-5.92

- Buffett Equity Bond Pre-Tax Yield: 0.22%

- Buffett Company Score (0-100): 50.00

US Credit Rating Downgrade

Last week the US credit rating downgrade by Fitch caused the market to drop. Fitch is one of three government agencies that issues credit ratings. (The three are S&P, Moody’s, and Fitch.) In Fitch’s ratings AAA is the best and was what the US was rated until last week when Fitch dropped it to AA+. Fitch stated the debt-limit issues and political standoffs surrounding them as the issue. This is not the first time the US credit has been downgraded. In fact, S&P downgraded the US credit rating to AA+ in 2011 listing political issues as well.

What does the US credit rating downgrade mean? Although the debt limit political issues are a cause for concern, the US credit rating downgrade is not something the financial big shots are worried about. Treasury Secretary Janet Yellen said she “strongly” disagrees with the downgrade, JPMorgan CEO Jamie Dimon said Fitch’s decision was “ridiculous,” and Warren Buffett said “There are some things people shouldn’t worry about…This is one.”

Sales of Starbucks in China Grow

Amazon is not the only company with a great earnings report, Starbucks just announced fantastic earnings as well. Last quarter sales grew 12% to a record $9.2 Billion. China has started coming out of its Covid lockdowns and it is showing. China is Starbucks 2nd largest market even though the average person in China drinks 12 cups of coffee a year compared to 380 in the US! How did Starbucks make China a good market? They adapted to the culture of China by offering a variety of iced and hot tea drinks instead of Coffee.

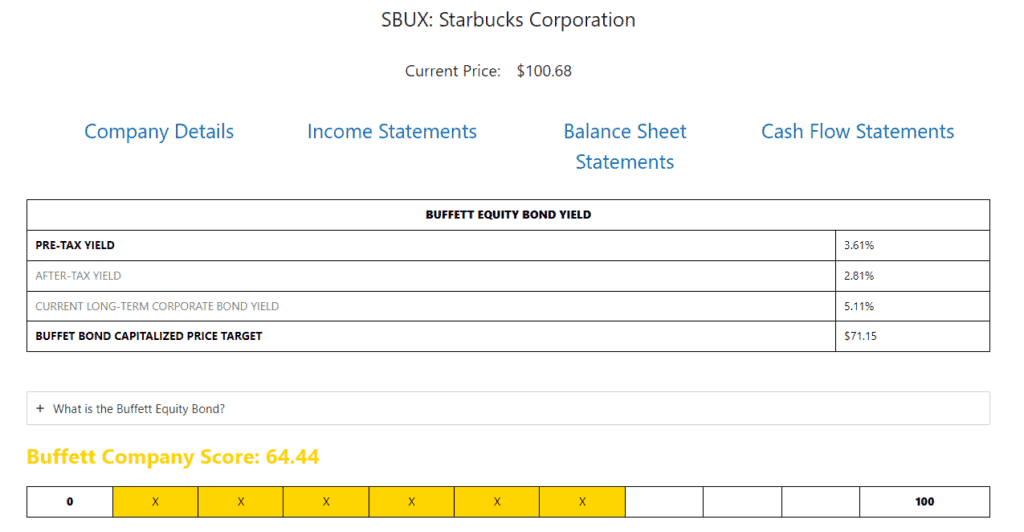

It pays to be aware of your surroundings, one business model may not be the best in every location around the world. Let’s take a look at how well Starbucks is doing now with our Buffett Fundamentals Tool:

Starbucks

- $SBUX

- Current Price: $100.68

- P/E: 30.49

- Buffett Bond Capitalized Price Target: $71.15

- Buffett Equity Bond Pre-Tax Yield: 3.16%

- Buffett Company Score (0-100): 64.44

Buffett Fundamentals Tool Results Image: Starbucks