Abercrombie & Fitch: The Stock of the year!

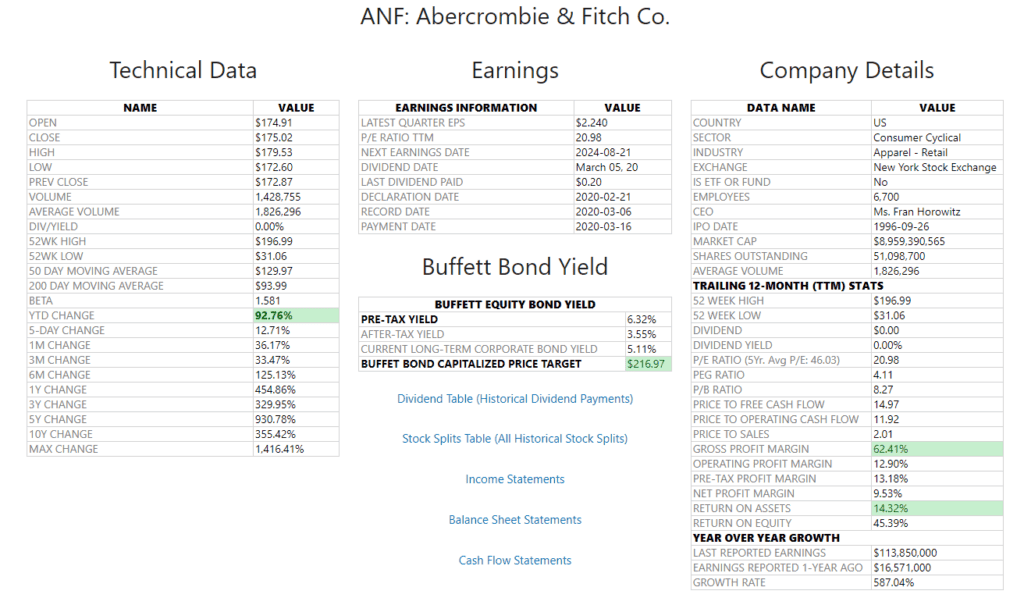

In 2024, Abercrombie & Fitch (ANF) has shown dominant financial performance. It is up over 92% on the year! (As of 6/3/2024). Check out our Stock Selector Tool screenshot of ANF below. Notice the 1-year change of 454.86% 🤯. During the first quarter, the company reported earnings per share (EPS) of $2.14, significantly exceeding the analyst estimate of $1.73. The company also reported revenue of $1.02 billion, surpassing the forecasted $963.26 million (InvestorPlace) (MarketBeat).

Key highlights include a 22% increase in net sales compared to the same quarter last year, with Abercrombie brands growing by 31% and Hollister brands by 12%. The company’s operating margin rose to 12.7%, up from 4.1% in the previous year. This strong performance was driven by effective inventory management, compelling marketing strategies, and a broad-based growth across regions (MarketScreener). We think the new Wedding Shop is the key differentiator in ANFs success. With wedding season in full swing, ANF has positioned themselves to continue thier dominance in 2024.

Overall, Abercrombie & Fitch’s robust financial results have led to an optimistic outlook for the remainder of the year, with expectations of sustainable, profitable growth (MarketScreener) (InvestorPlace).

Stock Selector Data for Abercrombie & Fitch ($ANF)

May Market Updates

Stock Market Outlook for June: Analysts from Fundstrat, particularly Tom Lee, predict a potential 4% rise in the S&P 500 for June, following a 5% gain in May. Key catalysts for this optimism include favorable seasonal trends, continued disinflation, low investor leverage, substantial cash reserves waiting to enter the market, and strong corporate earnings, particularly in the technology sector with companies like Nvidia leading the way (markets.businessinsider.com).

Top Gaining Stocks: Several stocks have shown significant gains this year. Companies like Abercrombie & Fitch (ANF), Nvidia (NVDA), and Amazon (AMZN) have seen notable increases in their stock prices in 2024.

AI and Technology Stocks: The tech sector, particularly those involved with AI, continues to be a major driver of stock market performance. Nvidia’s impressive earnings report has been a significant highlight, showcasing the growing importance and profitability of AI technologies. This has also influenced investor sentiment positively, encouraging more investment in tech stocks (markets.businessinsider.com).

Inflation and Interest Rates: Inflation trends remain a critical focus for the market. Continued disinflation could lead to expectations of potential interest rate cuts by the Federal Reserve later in the year. This expectation supports higher stock valuations as lower interest rates generally boost market performance (markets.businessinsider.com).