YP Investors Retirement Calculator

Our retirement calculator is free and will help you find how much you need to save for retirement, based on your retirement needs. The retirement calculator is also easy to use and customizable to your specific situation. Plan out what age you can retire and how long your savings will last. Check out the tutorial for instructions on how to use YP Investors retirement calculator.

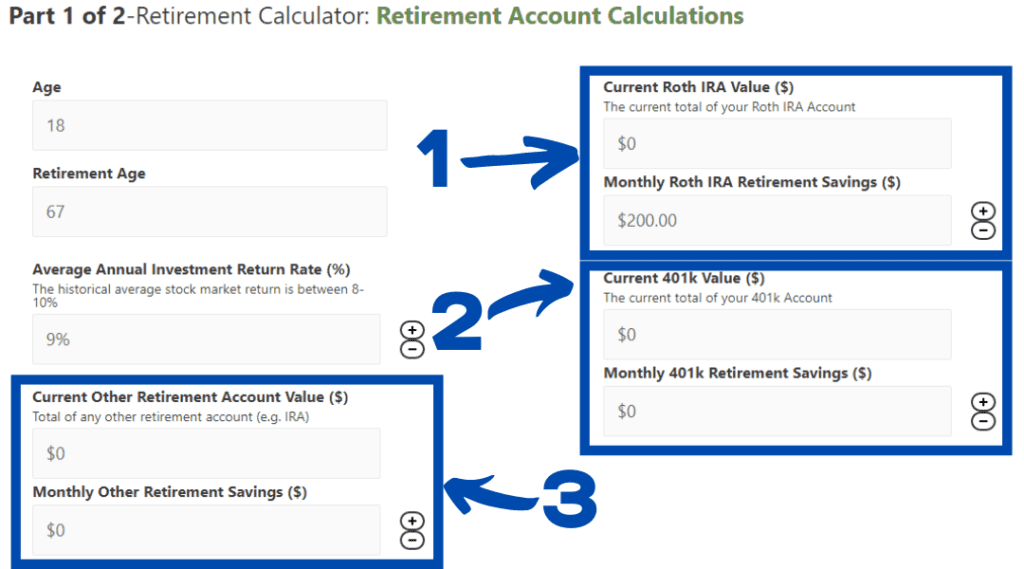

Part 1 of 2-Retirement Calculator: Retirement Account Calculations

The historical average stock market return is between 8-10%

Total of any other retirement account (e.g. IRA)

The current total of your Roth IRA Account

The current total of your 401k Account

Part 2 of 2-Retirement Calculator: Retirement Planning Calculations

How to Use YP Investors Retirement Calculator

Start with Part 1 of the Retirement Calculator and enter your savings information.

In Part 1, The Retirement Calculator, start by filling out your current age and your expected retirement age. Then select an average annual return on your investment (historically the Market, S&P 500, has returned about 8-10%.) Finally enter in your current retirement savings, if you have any, and then select which retirement savings account you will be saving for each month. Below are the details on each Retirement Account options.

Three different Retirement Savings options:

- Roth IRA: This is the most powerful way to save for retirement because of the tax benefits. When you put money into a Roth IRA it must be Earned and already taxed (After-Tax). This means you do not get a tax deduction for contributing to a Roth IRA, but the benefits greatly outweigh this. The main benefits are Tax-Free withdrawals during retirement, this includes any investment gains in your Roth IRA account. As of 2021 the maximum a person can contribute to a Roth IRA Account is $6,000 per year.

- Benefit: Tax-Free Retirement Withdrawals (tax-free gains), what you take out is yours during retirement!

- Downside: After-Tax Contributions (No tax deduction for contributions)

- 401k: A 401k retirement plan is the one of the most common setup for employees. Many employers will match a set amount of an employees contributions. For example if an employee puts 5% of their salary into the 401k plan, the company may match that 5% so the employee will actually get 10% of their salary in their 401k each year. Any company match is very powerful and if your company offers it you should take advantage of it. A benefit of a 401k retirement plan is the contributions are pre-tax and deductible. For example if your full salary is $100,000 and you contribute 5% ($5,000) then your taxable income is only $95,000 with the contribution deduction. The downside of a 401k is the retirement withdrawals are taxed as income. Wen you retire and start taking money out of your 401k, any money you take out will have state and federal income taxes.

- Benefits: Possible Company Match and Tax-Deductible Contributions

- Downside: Retirement Withdrawals will have State and Federal Income Taxes

- Traditional IRA/Other: A traditional IRA retirement account is similar to a 401k where the contributions are tax deductible and the retirement withdrawals will have state and federal income tax. Another type of retirement plan is a Pension Fund. These are not as common today with the 401k now available, but they way they work is an employer will setup and contribute to a retirement fund for the employee. When the employee retires they can receive retirement payments from the pension fund. There are also other retirement plans for small businesses and government workers like a Keogh Plan, 403b Plan, and XXX. The benefits of most of these plans include a tax deduction on any contributions, but the downside with all of these is the retirement withdrawals will be taxed as income.

- Benefits: Possible Tax-Deduction on Contributions

- Downside: Retirement Withdrawals will have State and Federal Income Taxes

Retirement Calculator Part 2, the Retirement Planner.

Part 2, The Retirement Planner, estimates your financial needs when you retire. Part 1 can be completed before or after Part 2, it’s up to you! After completing Part 1 you will have an estimate of your retirement account savings at the time you retire. Part 2 tells you if your retirement account value is enough to last your retirement.

Important Note: Your Part 1 Retirement Savings total will be automatically used in Part 2 the Retirement Planning. In the retirement planning it will deduct your monthly spending from your retirement savings.

To complete your Retirement Planning fill out your monthly retirement spending and your life expectancy. Make sure in your Retirement Spending you account for inflation and income taxes-if you are not using a Roth IRA. Estimate your monthly spend on housing, food, bills, and fun things, then add on inflation and estimated taxes. Finally add any expected income during your retirement such as Social Security, Pension Funds, Alimony, etc. Below are details about the types of retirement income.

Possible Retirement Income:

Social Security Income: In the US employers and employees pay a social security tax on their salary. Each paycheck a portion goes to fund social security. This is a government run system that pays for Americans when they retire. It is basically a government retirement plan. Americans can start taking social security at age 62 and can defer taking it up to age 70. Once a person starts social security they will receive a monthly payment from the government. The payment amount depends on how long you have been working, how much you made each year, and when you opt to start social security. The longer you wait the larger your payment will be.

Pension Funds: A pension fund is a retirement plan where employees and employers contribute to during employment. The money is typically invested on behalf of the employees and the account will grow so that when the employee retires they will receive retirement payments. The most common way pension funds work is employees will receive pension payments equal to a specific percentage of their average salary paid during their last few years of employment. If you have a pension fund it will provide extra income during your retirement. Contact your employer for an estimated retirement payment from the fund and add it to the Retirement Planner retirement income.

Alimony: Alimony is money paid by one ex-spouse to the other after divorce has legally been filed and the marriage has ended. The payment is intended to support reasonable living expenses of the ex-spouse. Alimony is also sometimes called spousal support. If you already receive alimony and will continue to receive it during retirement you can add it to your retirement investment income.

- YP’s Retirement Calculator Reveals Your Path to Financial Freedom

Whether you are just graduating high school and beginning your adult life or are nearing the end of your work life and are ready for retirement, YP Investors retirement calculator will help you plan out your path to retirement. This calculator was made to help everyone think ahead in life and make plans to live happy and financially free in the future. It is never too late to start saving for retirement, starting at any point is always better than never starting. Good luck on your investments and we hope you are able to live financially free in the near future if you don’t already!